Fin-Tech

Written by

Sandeep Ozarde

Written by

Sandeep Ozarde

Fin-Tech

Money's attractiveness is maximized from the perspective of end-users across payment and store of value functions, where money maximizes private benefit while minimizing costs and risks. Cash, traditional commercial bank deposits, new forms of retail-fast payments systems (e.g. India's Unified Payments Interface (UPI), Sweden's Swish system, the upcoming FedNow system, etc.) are all competing forms of money and means of payment that are already available to end-users today when evaluating the potential for CBDC to improve money.

The recent explosion in the popularity of cryptocurrencies such as bitcoin and its blockchain technology suggests a revolution in the creation of 'fiat' cryptocurrencies is underway, leading to a potential 'winner-take-all' between crypto-assets and CBDC. In the current market landscape, even relatively stable traditional currencies such as the USD, UK Pound, and Euro have all experienced periods of extreme volatility in recent years. Risks relating to the integrity of fiat currencies have also meant that many of the traditional 'stores of value functions have tended to move to non-fiat instruments such as precious metals.

CBDC has a couple of interesting favourable properties. The two most relevant ones are the following:

The potential applications for CBDC are broad and interdependent upon the supply, cost, and usage characteristics of the currency itself. The key challenge for CBDC is to provide each of these benefits while simultaneously assuring that it cannot be abused. For example, using "cashless" mobile payments, even more, transactional efficiency can be realized, yet this could be abused by anyone party to demand the equivalent in cash if the other party tries to bypass the system (a form of a double-spending attack). Centralized deposit and credit functions within banks already provide "zero-fee", and "zero-risk" transactions to end-users.

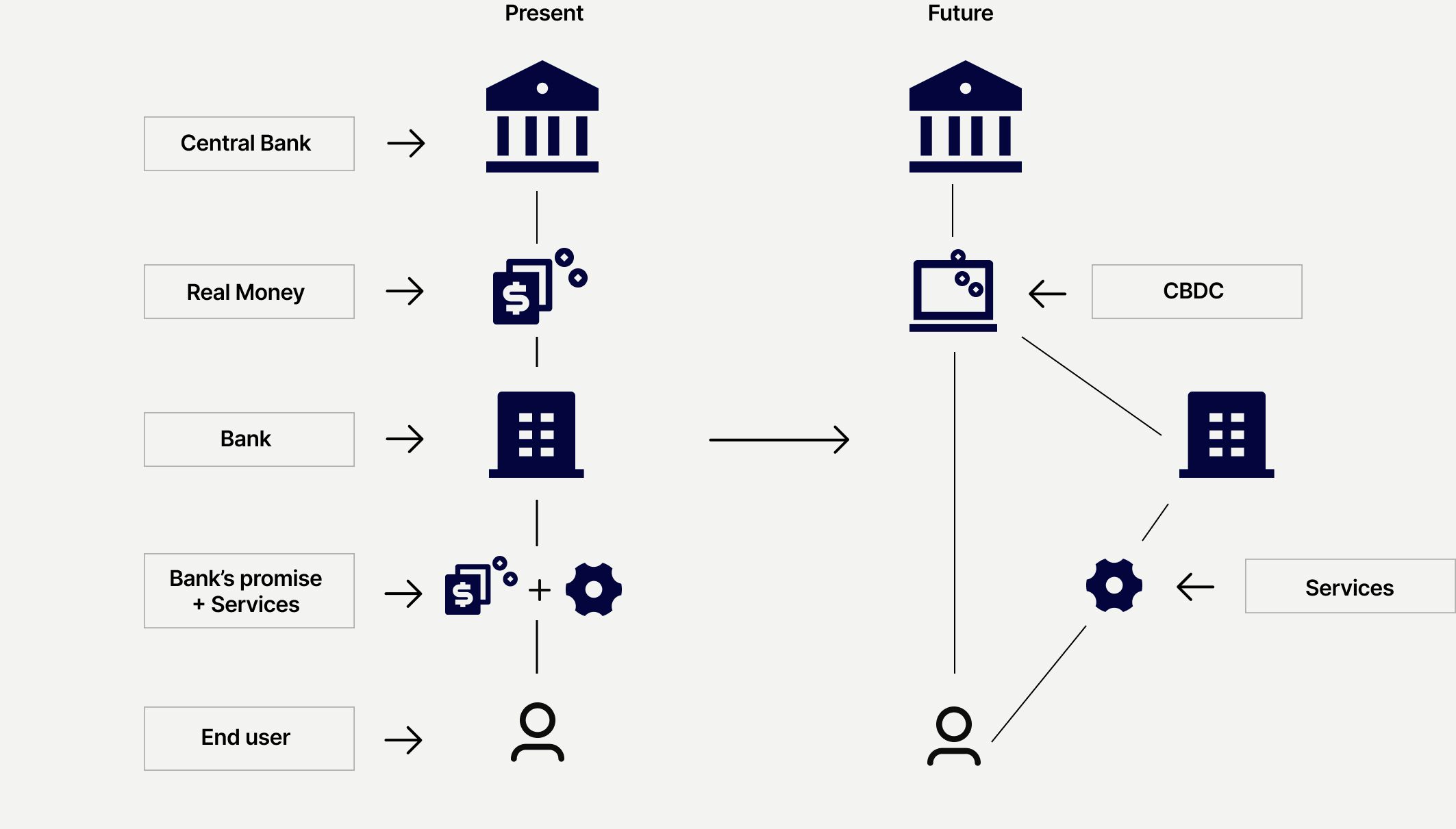

Possible Future: The introduction of CBDC could remove risk from users, and allow banks to focus on services. Image Credit: daml.com

At the current time, most retail payments today are still conducted with one or two forms of commercial bank deposits, or as deposits on a specific bank's balance sheet (that is, insured, insured demand deposits, or retail time deposits). These deposits have low security and liquidity, and typically attract a higher cost of funds than money to support their safe storage, which is equivalent to putting money into a cashbox. These commercial bank deposits are typically very well-regulated, and there is a bank of one in each geographical area where they are held. In contrast, money as a store of value is traditionally presented as a commodity, usually in a commodity-like unit such as pounds sterling or dollars or some other fiat money such as the Brazilian Real or Indian Rupee.

The Internet of Things (IoT) may well be the most transformative technology for payment as we know it today. As previously explored, the capabilities of IoT would broaden the range of "money" enabled by CBDC to include payment, loyalty points, transactional capital, as well as control and autonomy. Because of this, payment, loyalty point, transactional capital, and control and autonomy are all categories that may see CBDC displacing cash, UPI, and SW-based payment services. Financial technology companies in particular are investing in differentiating features that differentiate their services and solutions in an increasingly competitive banking and payments ecosystem.

The concept of CBDC is successful in driving real economic growth. A new class of CBDCs will have to be created for emerging markets to meet the retail and payment demands. Distributed ledger and blockchain technologies, microfinance technologies, and now the US dollar for CBDC could help give the region the next stage of high growth that it deserves.

Central banks around the world, including in China and Europe, are revving up CBDC projects to fend off threats from cryptocurrencies and improve payment systems.

China is currently well ahead of major peers in developing a CBDC (which they call a Digital Currency Electronic Payment, or DCEP) and is already at the point of extensive pilot testing. Given the country’s sprint to becoming a cashless society, fast adoption of DCEP over the next five years relative to other CBDCs. Meanwhile, work on a digital Euro is now underway (we expect imminent announcements from the ECB) and US policymakers are also now warming up to the idea of a Digital Dollar.